Making Good Use of the European Payment Order in France

The European Payment Order (EOP) Explained:

The European Payment Order (EOP) procedure covers all cross-border civil and commercial matters. It makes the noted exceptions however of issues relating to:

- revenue, customs or administrative matters,

- state liability for acts and omissions in the exercise of state authority,

- matrimonial property regimes,

- bankruptcy, insolvency proceedings

- social security,

- non-contractual obligations, unless an agreement exists between parties

The EC Regulation on creating a European Order for Payment Procedure has had a particular influence on debts involving SMEs and b2b debts, on which rests a large part of the European economy. The reliability of this simplified procedure has increased trust between businesses and creditor-debtor relationships. It has been thoughtfully crafted to work harmoniously with national jurisdictions and has been imagined as standing independently from the national policies of the different member states (cf. Art 1.2 of Regulation (EC) No 1896/2006)

Debt Collection in France:

The European Payment Order in France:

How do I apply in France?

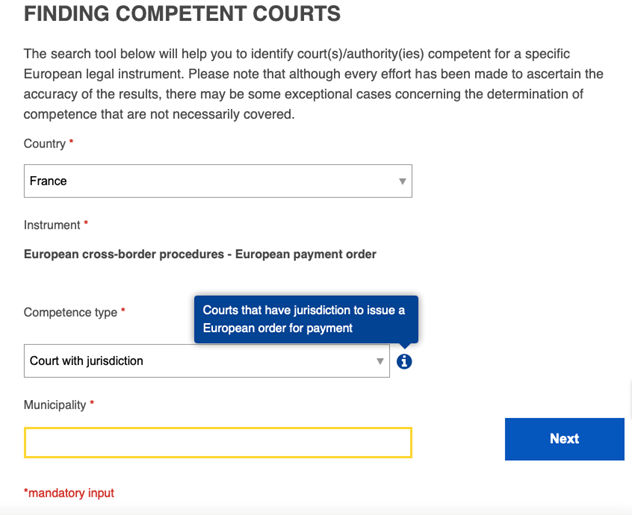

In France, the judgement is likely to fall on the president of the Chamber of Commerce. The competent court is that of the defendant’s place of residence and is seized by filing Standard Form A either by post or online application.

The procedure is low-cost as it aims to simplify and democratise the application process for EU citizens. The newly added Article 1425 of the Code of Civil Procedure stipulates that the costs are to be advanced by the applicant and deposited by the clerk’s office at the latest 15 days following the application. The competent court must examine the application as soon as possible, provided that all relevant conditions are met.

How often is this procedure used in France?

A Practical Guide to Making Good Use of the European Payment Order:

Step 1: Fill out Standard Form A and File for your EOP

Step 2: Determine the Competent Court in your Case

If you file your application with the wrong Courts national legislatures will take over in defining the appropriate competences.

Step 3: Wait out the Delays while the Court Examines your Application

You will want to remember that in the event your claim is denied by the Courts, there is a duty to inform the application of its reasoning. While the EOP procedure does not provide for the proceedings for a right of appeal, due to its expedited nature, the applicant is however in their right to re-apply a new form or proceed with an alternative measure of debt collection.

Remember to respect the delays dictated to you by the Courts. If these delays are not respected the Courts will reject your application.

Step 4: Have your EOP Properly Enforced

Getting your EOP enforced requires you to provide to the appropriate authorities a copy of the European Payment Order and if relevant, its translation.

In the event that your debtor does contests the requested claims, the case is sent to the ordinary civil courts and the jurisdiction will be transferred to national courts. Challenged claims are outside of the scope of EU jurisdictions. However, there remains the possibility for an alternative EU measure through the newly established European Small Claims Procedure.